Page 30 - SC SCAR 2023 ENGLISH Flipbook

P. 30

PART 2 REGULATORY PERFORMANCE AND OUTCOMES

PART 2

Regulatory Performance and Outcomes

INTRODUCTION

The SC’s mission to promote and maintain a fair, efficient, secure and transparent capital market is operationalised through its regulatory functions, which consist of rulemaking, gatekeeping, surveillance, supervision, complaints handling and enforcement. This chapter provides an account of the SC’s key regulatory activities in 2023, which were underpinned by proactive risk surveillance to identify priority areas and enable the SC to optimally focus its efforts and resources.

MONITORING AND MANAGEMENT OF SYSTEMIC RISK

Despite the improvement in global financial markets following lower energy prices and a slower pace of monetary tightening, the capital market remained sensitive to potential deterioration in economic fundamentals such as persistently elevated core inflation and lingering geopolitical tension. Against this backdrop, the SC remained vigilant of potential downside risks that may pose a threat to the systemic stability of the Malaysian capital market.

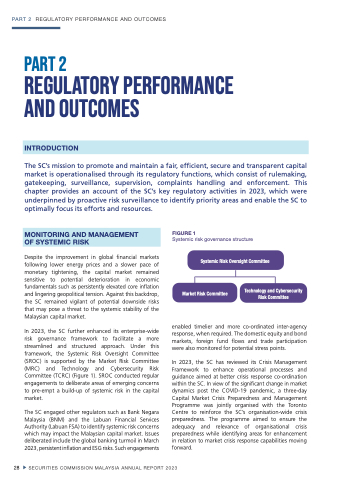

In 2023, the SC further enhanced its enterprise-wide risk governance framework to facilitate a more streamlined and structured approach. Under this framework, the Systemic Risk Oversight Committee (SROC) is supported by the Market Risk Committee (MRC) and Technology and Cybersecurity Risk Committee (TCRC) (Figure 1). SROC conducted regular engagements to deliberate areas of emerging concerns to pre-empt a build-up of systemic risk in the capital market.

The SC engaged other regulators such as Bank Negara Malaysia (BNM) and the Labuan Financial Services Authority (Labuan FSA) to identify systemic risk concerns which may impact the Malaysian capital market. Issues deliberated include the global banking turmoil in March 2023, persistent inflation and ESG risks. Such engagements

FIGURE 1

Systemic risk governance structure

Systemic Risk Oversight Committee

28

SECURITIES COMMISSION MALAYSIA ANNUAL REPORT 2023

Market Risk Committee

Technology and Cybersecurity Risk Committee

enabled timelier and more co-ordinated inter-agency response, when required. The domestic equity and bond markets, foreign fund flows and trade participation were also monitored for potential stress points.

In 2023, the SC has reviewed its Crisis Management Framework to enhance operational processes and guidance aimed at better crisis response co-ordination within the SC. In view of the significant change in market dynamics post the COVID-19 pandemic, a three-day Capital Market Crisis Preparedness and Management Programme was jointly organised with the Toronto Centre to reinforce the SC’s organisation-wide crisis preparedness. The programme aimed to ensure the adequacy and relevance of organisational crisis preparedness while identifying areas for enhancement in relation to market crisis response capabilities moving forward.